The federal 25C Energy Efficient Home Improvement Credit has become one of the most valuable incentives available to homeowners looking to upgrade their heating and cooling systems. Designed to encourage energy-saving improvements, this credit helps reduce the upfront cost of installing efficient technologies like heat pumps, ductless mini splits, insulation, and other qualifying upgrades. But what many homeowners don’t realize is that the window to maximize this credit is closing fast. Beginning in January, key portions of the credit are scheduled to phase out or drop significantly, making now one of the last and best opportunities to take full advantage of the savings.

What Is the 25C Tax Credit?

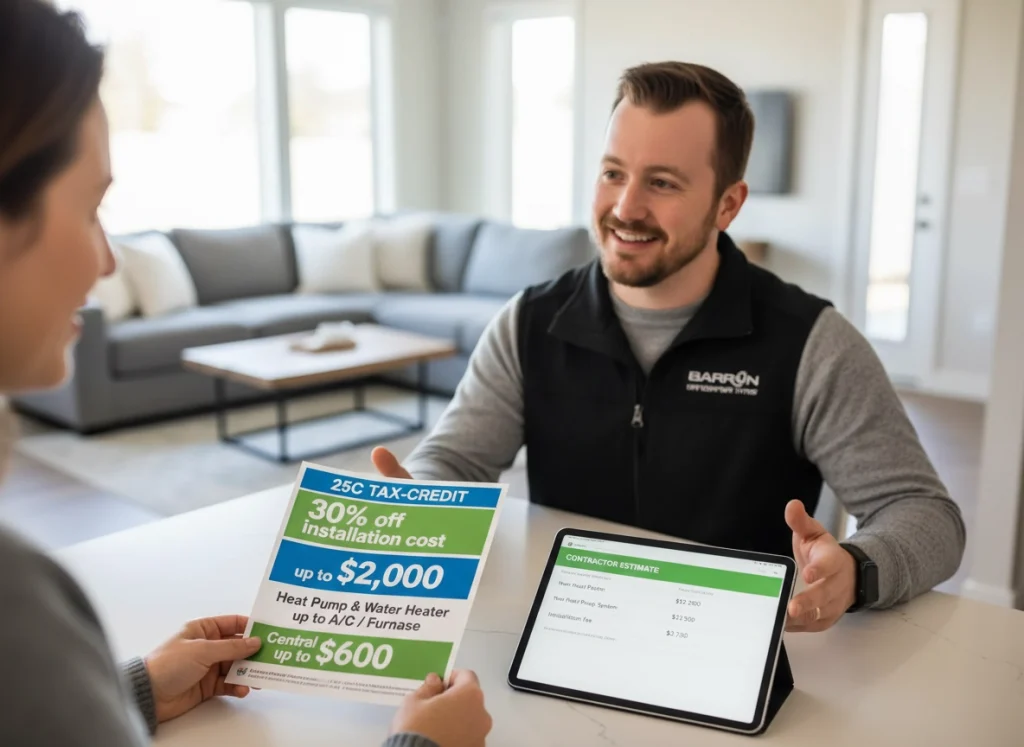

At its core, the 25C tax credit provides a dollar-for-dollar reduction of your federal income tax for qualifying energy-efficient home improvements. For heat pumps and ductless mini splits specifically, homeowners can claim up to 30% of the total project cost, with a maximum credit of $2,000 per year. This is a meaningful incentive, especially when investing in high-efficiency systems that provide both heating and cooling while lowering monthly energy bills. For homeowners who have been on the fence about replacing an aging HVAC system or upgrading their home’s comfort, the credit helps bridge the gap between short-term affordability and long-term energy savings.

Use It Before It’s Too Late!

What makes the 25C credit especially important right now is that 2025 is the final year many households will be able to access the current higher benefit levels. Due to planned federal policy changes, the credit is expected to scale back starting in January. For some homeowners, that could mean losing hundreds, or even thousands, of dollars in potential tax savings. Households with older, less-efficient systems may also face rising energy costs as utility rates continue to increase. Upgrading now allows families to not only claim the 25C credit while it’s still at full strength, but also lock in long-term savings in the form of lower monthly utility bills.

Beat the Demand

Another reason to act soon is the growing demand for heat pumps and ductless mini splits. These systems have become the go-to solution for homeowners seeking better comfort, improved air quality, and year-round efficiency. As the deadline approaches, installers are expecting a surge in demand, which can lead to longer wait times for appointments and limited inventory. Scheduling a consultation now ensures homeowners can complete their project before the end-of-year rush, making it easier to qualify for the credit on 2025 taxes.

For anyone considering home energy improvements, the next few months represent a unique window of opportunity. The 25C tax credit offers meaningful financial incentives, but only for a limited time. Upgrading to a modern heat pump or ductless mini split now means maximizing tax benefits, improving comfort, reducing energy costs, and preparing your home for the future, all before the credit shrinks in January. If you’ve been waiting for the right moment to invest, that moment is here.

Our team of Home Performance Experts has served the I-5 corridor from Blaine to Marysville, Oak Harbor to Concrete, and the San Juan Islands since 1972 with a mission of Improving Lives™. We look forward to serving you too! Contact Barron Heating today for a new high-efficiency HVAC installation.